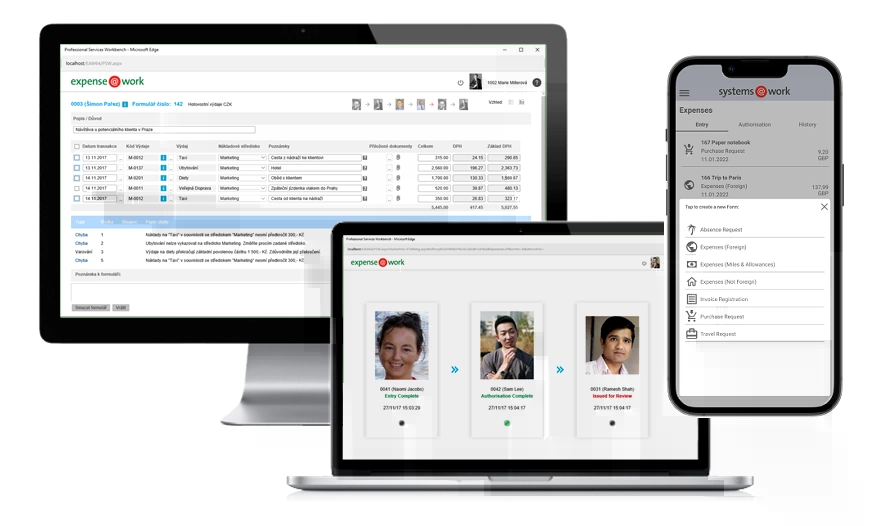

With the help of expense@work, it only took three months to finish a complete digital transformation from a purely manual expense management process. This transition made things easier for us, which resulted in saving half of the working hours of one financial accountant. The process of travel expenses approval, reimbursement of business trips, and petty cash has become much faster and all documents are now digitally archived and easy to find. I believe that the mobile version of the expense management solution will be equally successful.